My father was a taxman. Actually, he was a CPA, a job he loathed. As a child, I remember tax season very well. He worked long hours and came home in a foul mood. We three kids were instructed to leave him alone while he decompressed in his chair, reading the paper after dealing with other people’s taxes. Dad often told us never to be accountants, and I happily obliged.

From my father, I inherited the importance of honesty and fairness regarding taxes.

My aversion to all things math-related and to tax preparation persists to this day. When I landed my first job as a teacher, and after I was married a year later, my father took care of the tax returns. It was only when my husband went into practice as a psychiatrist and things became a bit more complicated that we hired our own accountant. By that time, my father had retired and was happy to hand us over to a Chicago affiliate of his firm.

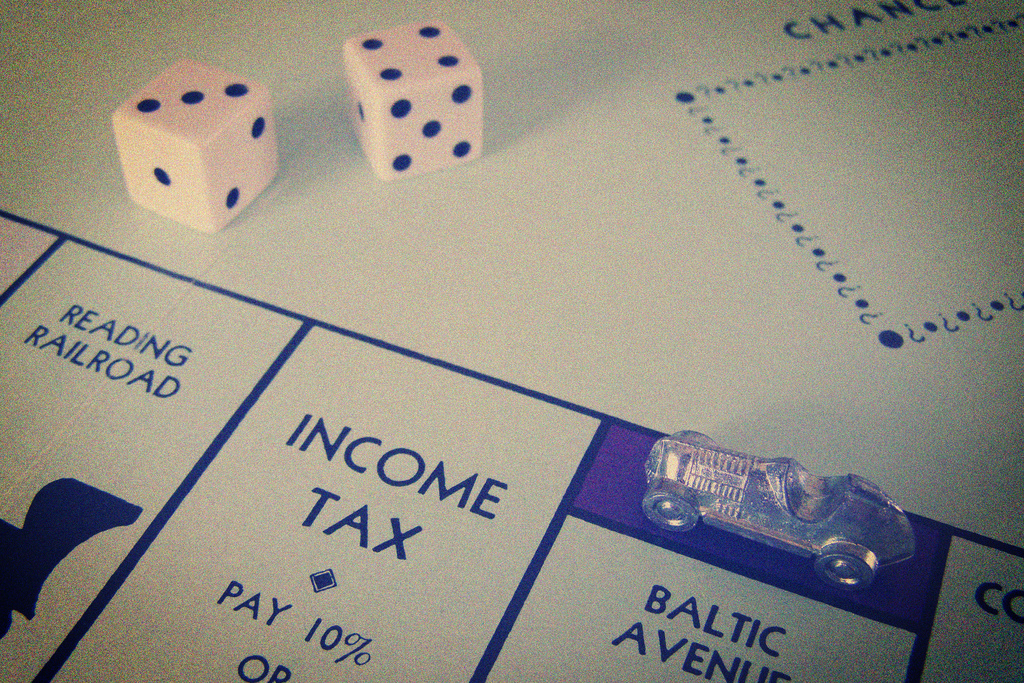

From that time on, we paid taxes – lots of taxes. Like most Americans, our income taxes were like a game of Monopoly that’s outcome was rather unpredictable. If we landed on the wrong spot or picked up a bad card from the Chance pile, we paid. Some years we had to pay more. Some years, we got a refund. We often had no idea why.

A couple of years ago, this meme supposedly with numbers taken from Time magazine, went around the Internet. And no, I didn’t check with Snopes to see if it was fake news. But it reflects in spirit the way I feel about taxes these days:

I’ll pay.

Take my $1.37… I want PBS and NPR.

Take my $.46… I am all for federal funding of art programs.

Take my $.46… I love museums, colleges, and libraries.

Take my $.11… I support developing minority businesses.

Take my $.66… I am for entrepreneurship and innovation.

Take my $1.60… I want us to export more goods overseas.

Take my $0.43… I would like to see more American manufacturing.

Take my $0.88… I think community policing needs improvement.

Take my $1.48… I support programs for women.

Take my $1.55… I believe in due process for all.

Take my $0.48… We need a civil rights division in the justice department.

Take my $0.38… I think we need to defend our Mother Earth.

Take my $0.03… I know more work needs to be done to moderate climate change.

Take my $8.95… because we need to develop sustainable energy.

Take my $2.71… we should reduce our carbon footprint.

If saving these programs means I’m out $22.36 a year, I’m good with contributing my $.07 a day to save American jobs and these federal programs. Oh heck, I’m willing to pay for myself and two more people! That’s a lot of good stuff for $67.08/year!

Of course, that’s not how things work. We pay our fair share but have no control over how our money is spent. Do I want to pay to feed the military-industrial complex? Do I want to contribute to building a wall I don’t believe will help, that Mexico was supposed to pay for? I accept, as Benjamin Franklin famously said, “nothing can be said to be certain, except death and taxes.” So, my husband and I pay our taxes and we grumble that, as the 1966 Beatles song Taxman, written by George Harrison, laments, they are too high.

If you drive a car, I’ll tax the street

If you try to sit, I’ll tax your seat

If you get too cold I’ll tax the heat

If you take a walk, I’ll tax your feet

If our taxes went to provide good healthcare for all or to expand the social service safety net, sure – take even more. Last year, I campaigned for a local referendum, which remarkably passed, to raise our already very high property taxes to fund our schools. We all thought the extra tax money would provide more opportunities for children in our community. Instead, it just kept the status quo. Nothing was cut (meaning the arts and social workers) but nothing was added either. Sad.

If everyone played by the same rules, despite the fact that I don’t agree with how our hard-earned money is used, I guess I wouldn’t feel so grumpy on April 15. Of course, we know that’s not how the game is played. Jeff Bezos pays no corporate income tax for Amazon, despite earning a profit of $11.2 billion. And don’t get me started about his arch-enemy, Donald J. Trump, who desperately does not want us to see what, if anything, he has paid. Too bad my father wasn’t their accountant.

My father was a very honest man who believed in treating even his smallest clients with dignity. He dressed formally and carried his adding machine into closet-like backrooms of small businesses where he prepared returns that followed the letter of the law. An FDR Democrat, he believed paying one’s fair share of taxes was a patriotic duty to ensure the common good. Those who could afford more had an obligation to help pay for those who could not as well as to support the commons, the services we all need to survive.

From my father, I inherited the importance of honesty and fairness regarding taxes. When I pass Go, I will take the $200 to which I am entitled. If I land on Pay Income Tax, or receive a Chance or Community Chest card telling me I owe money, I pay. I don’t cheat at Monopoly or taxes. Too bad the taxman never cometh for the players who own those hotels on Boardwalk and Park Place, bankrupting the other players, while paying very little or even nothing at all.

I invite you to read my book Terribly Strange and Wonderfully Real and join my Facebook community.

Boomer. Educator. Advocate. Eclectic topics: grandkids, special needs, values, aging, loss, & whatever. Author: Terribly Strange and Wonderfully Real.

Well said, Laurie. I agree with your sense of fairness and am SO tired of these corporate grifters in charge of our government now. The rich get richer and inequality grows. The social safety net is torn apart, infrastructure work is languishing and our country is torn apart. Where is the common good? (By the way, the Internet tool to check on scams or otherwise bad info is Snopes.)

Just read your post and I think we agree that so much is wrong with how our country operates these days. So sad that my kids struggle in ways that we did not at their stage of life. Income inequality is a huge problem that promises t get worse. Now I have to edit my piece. I knew it was Snopes. LOL!

Great story, Laurie! I love the way you use Monopoly, not only as your Featured Image, but weaving it into the story as well. And your Eugene O’Neill-inspired title resonated with me. Not surprising that we both refer to the Beatles song – and I will quickly point out that I wrote my story before I read yours, so I wasn’t copying!

Honesty and fairness regarding taxes is a wonderful idea. I wonder if we will ever get there in reality.

I suspected you would use the Beatles song for your title, so I resorted to Eugene O’Neill. At any rate, once I started writing I thought about how in Monopoly I seem to land on pay income tax frequently. At least it’s only as little as 10% of you are short on money. Will taxes ever be honest and fair? Not for those who can afford to pay the most.

Wonderful Monopoly analogy, Laurie–we do indeed roll the dice. This year’s “simplified” version had me owe the Feds a lot while getting a big refund from the state. Go figure. Maybe some sort of flat tax would be better, although it would have put your father out of business.

Marian, I can’t pretend to understand this, but I think flat taxes end up even more unfair. This year we got a refund. Have no idea why. And of course, that means the government kept our money ll year without us earning any interest. Still, will be helpful to pay my dental bill. Sad that Medicare doesn’t cover dental when lots of folks my age need it and many can’t afford to pay. And by the way, I almost always lose at Monopoly.

Laurie, after I grunted out my dismay, I read this and felt so much better. You instantly and elegantly explained how an honest, hard-working American experiences the inequality in not just our country, but the world. I think the horror of it is that it just gets worse. And yet, although I speak for the pions of the world, I’m proud to stand with them, proud of folks like you, your father and mine. Honest and just. Thank you Laurie.

Thank you, Patty. I think/hope most people feel this way. We only hear from the ones who don’t and dominate the news cycle. Welcome to Retrospect!