April, 2002, a month before Dan’s retirement

I came across this story, written 3 1/2 years ago, but never published, the last time the Retirement prompt came up. I’ve decided to publish it now. It is all true today.

Dan went to work for Andersen Consulting on January 3, 1994. This is not to be confused with Arthur Andersen, which was a good thing. They were both under the aegis of Anderson Worldwide, but AC was the consulting piece of the pie, or so it was supposed to be. Dan came in as a full-equity partner, which was quite unusual for a firm like this. Normally one came in right out of business school and worked one’s way up. Andersen Consulting was building an IT strategy consulting practice, which was Dan’s expertise, so they hired senior people. He had to buy his partnership stake, but the firm helped him with this.

He was well-compensated, but they expected much from their partners. He traveled four days a week and had a high sales quota. The company was highly profitable and became the largest consulting company in the world. Arthur Andersen saw this and began encroaching on the territory and confusing the marketplace. AC protested, eventually taking their complaint to the World Court in Brussels. It took years, but the companies separated. As part of the settlement, AC lost the right to use the name Andersen and became Accenture (a made up name). Shortly thereafter, they went public. Dan’s partnership stake became zero-basis shares in the new company, worth a great sum of money.

We also know that during the Enron scandal, one corrupt Arthur Andersen partner brought down the entire company, causing it to go bankrupt. They were later exonerated, but it was too late. The company had folded.

Accenture wanted to continue to make room at the top for well-paid executives, so pushed out partners over the age of 50, making it attractive for them retire. Dan was 51 at the time of the IPO, and there were stock incentives to retire at that time, so he did, in May, 2002. He also had a five-year non-compete clause, enforceable since Accenture held the stock.

At his annual physical that year, he told his doctor that he was about to retire. The doctor said, “Have a plan. Make sure you stay busy”. And Dan thought he did have a plan for the first several years.

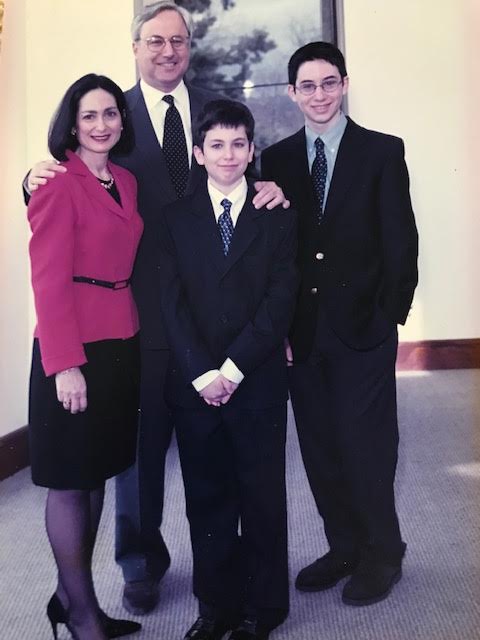

Life on the road is difficult. You don’t eat well, you can’t exercise with regularity. Dan had put on a lot of weight. When he looks at the photo from Jeffrey’s bar mitzvah, the month before he retired, he shudders. He was at his all-time heaviest. So his first project was to lose weight, which he did by getting back to regular exercising and eating a bit healthier. Dan’s motto is “calories in, calories out”. He also says that he runs to eat. He does not follow fad diets (or any kind of diet) or even nutritional guidelines. He exercises his butt off, literally. He took off probably 30+ pounds that first year.

We also began a major renovation of our Martha’s Vineyard home, finally implementing the “Master Plan” that Patrick Ahearn envisioned years earlier. We now had the money to fulfill the dream. We pushed out the back of the house, adding space to the kitchen, and moving the laundry to the ground floor off the kitchen, moving the Master Bed and bath to the back of the house and finishing the 3rd floor, which had been unfinished space. This all began when Patrick was in the second floor laundry room at the back of the house one day and commented that it had the best view of our beautiful garden. After years of Patrick’s lobbying, we also added a small pool. I had resisted, but now love it.

All this began only months after we finished a major renovation of the Newton house. I was exhausted, so this became Dan’s baby. We did enjoy visiting over the winter to check on the progress. We stayed a few blocks away in a lovely inn. The kids shared a room that had a TV and were in heaven. “Tea” was served in the late afternoon; so civilized, and books and a chess set were scattered about to provide entertainment on a rainy day. Staying someplace other than our own house was novel and enjoyable.

Dan had the time to play golf, go out west for ski trips (and bring David along). When it was time to look at colleges, I did the local, driving trips, Dan took David on any trips that required a flight. They took a boating course at Annapolis, stopped at the Naval Academy (no, David had no thoughts of applying) but looked at Wesleyan and Princeton on the way home. We spent all summer on Martha’s Vineyard.

As it became clearer that the public school was not an appropriate fit for Jeffrey, Dan and I looked at schools, found the right one, then found a special needs lawyer before Newton agreed to pay for the school, 18 miles away from Newton in Sudbury, MA. A van picked up local students, but during certain times of the year, or as Jeffrey got deeper into his studies, we often found we drove west at the end of the day to pick him up and eat an early dinner with our child out there.

As Dan described it, he “had the band-width” to devote to Jeffrey’s needs as it became clear he was willing to work hard at his schooling to get into a good college and his special ed school couldn’t offer the curriculum he needed. Dan found a college chemistry professor to come twice a week to Sudbury, after school, to tutor Jeffrey so that he would be prepared to take the SAT II in chemistry. Dan found a pre-calculus tutor from Martha’s Vineyard High School so Jeffrey was prepared for calculus in the fall. That tutor wrote a letter of recommendation for Jeffrey. And Dan found an on-line physics course for Jeffrey his senior year, and supplemented with a tutor who came to our home. Jeffrey got into Brown, early decision. Dan did the tactical thinking. I sat with him to ensure the homework was complete and gave him the emotional support he needed.

Shortly after Dan retired, he looked for someone to manage our newly-acquired wealth. He interviewed many different people, but settled on a pair of brothers working for Lehman Brothers, as described in Mama, Don’t Let Your Children Grow Up To Be Cowboys.

It all went well for a while. We had fun, the market rose, Dan didn’t pay close attention. Then, in September of 2008, the market crashed and with it, Dan. We lost a huge amount of money. Dan went out of his mind. We tighened our belts, rented the Vineyard house one season (I hope to never do that again). Changed money managers. Slowly, things got better, but it took a huge emotional toll on Dan .

With the children launched, we had the time to travel. We took some interesting golf cruises (I don’t play, but they provided good touring options for the non-players).

Our children live far away. We don’t get to see them often, though with a young granddaughter in London, our trips now tend to revolve around visiting her. We try to take about one other interesting trip a year, now that it seems to be safe to travel again. Dan continues to exercise and play golf when he isn’t injured. He does a bit of volunteer work at the Brandeis International Business School, though even that seems to have ground to a halt. We see a lot of movies, get together with friends. But he watches the money like a hawk. He fulfilled his “plan” long ago.

Retired from software sales long ago, two grown children. Theater major in college. Singer still, arts lover, involved in art museums locally (Greater Boston area). Originally from Detroit area.

Wow Betsy, once again am amazed at your recall of dates, chronology and events, and thanx for sharing Dan’s retirement story.

The ups and downs of the market certainly impacted many of us and you tell your own family’s story so well.

And of course it got me thinking about the Enron saga we saw dramatized on Broadway years ago!

“Have a plan” is good advice!

Thanks, Dana. But the plan needs to encompass a long time line…what happens when everything on it is done? What’s next?

I think retiring at a young age is harder for men. So much of who they are is their job. Bravo to Dan for putting his energy into his sons’ eductions and volunteering. Sounds like he has found ways to be productive.

I think you are right about men defining themselves by what they do, Laurie. Dan was busy with projects and his kids for many years. He took up golf in a serious way when he retired too, but this summer, back ailments got in the way of that, so he has had a rough time.